Companies perform bank reconciliation at regular intervals, usually at the end of each month. It is also recommended that they should carry out a bank reconciliation should at least every month if not any sooner. In the past, it was common for a company to prepare the bank reconciliation after receiving the monthly bank statement and before issuing the company’s balance sheets. However, with today’s online banking a company can prepare a bank reconciliation throughout the month (as well as at the end of the month). This allows the company to verify its checking account balance more frequently and to make any necessary corrections much sooner. In accounting, a company’s cash includes the money in its checking account(s).

Bank Statements: Types, Analysis, and Importance

In addition to the bank statements, additional supporting documentation is obtained to validate the completeness and accuracy of these discrepancies between the two systems. The final entry is to record the bank service charges that are deducted by the bank but have not been recorded https://www.business-accounting.net/ on the records. Following the completion of the reconciliation journals are required to post the adjustments for the reconciling items. The journals vary depending on the type of reconciling items, and typical examples are shown in our bank-reconciliation journal entries post.

How Often Should You Reconcile Bank Statements?

- Bank reconciliation is a crucial financial process for businesses to ensure that records match bank statements.

- If you want to prepare a bank reconciliation statement using either of these approaches, you can take balance as per the cash book or balance as per the passbook as your starting point.

- As mentioned above, timing differences do not require any adjustments in the bank book balance.

- The reason could be that deposits are in transit or outstanding checks have not yet been reflected.

- Therefore, when your balance as per the cash book does not match with your balance as per the passbook, there are certain adjustments that you have to make in order to balance the two accounts.

In addition, there may be cases where the bank has not cleared the cheques, however, the cheques have been deposited by your business. Therefore, the bank needs to add back the cheque’s amount to the bank balance. You need to adjust the closing balance of your bank statement in order to showcase the correct amount of withdrawals or the cheques issued but not yet presented for payment. Bank reconciliation is undertaken in order to ensure that your balance as per the bank statement is correct. In such a case, you simply need to mention a note indicating the reasons for the discrepancy between your bank statement and cash book.

Create a free account to unlock this Template

To reconcile bank accounts, compare your bank statement to your records, noting any discrepancies. Adjust your records to match the bank statement, considering deposits, withdrawals, fees, and errors. Reconciling bank statements with cash book balances helps you, as a business, to know the underlying causes that lead to such differences.

The Benefits of Reconciling Your Bank Account

The above case presents preparing a bank reconciliation statement starting with positive bank balances. As mentioned above, debit balance as per the cash book refers to the deposits held in the bank. This balance exists when the deposits made by your business at your bank are more than the withdrawals.

Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates. Finally, compare your adjusted bank balance to your adjusted book balance. Since you’ve already adjusted the balances to account for common discrepancies, the numbers should be the same. You should perform monthly bank reconciliations so you can better manage your cash flow and understand your true cash position.

Starting with an incorrect opening balance can lead to errors in the reconciliation process. It’s essential to ensure that the starting balance is accurate before beginning the reconciliation process. 10% of all occupational fraud cases in small businesses are due to bank account reconciliation errors.

You will know about such information only when you receive the bank statement at the end of the month. As a result, the bank debits the amount against such dishonored cheques or bills of exchange to your bank account. There are times when your business entity deposits a cheque or draws a bill of exchange accounting policies discounted with the bank. However, such deposited cheques or discounted bills of exchange drawn by your business entity get dishonored on the date of maturity. One of the primary reasons responsible for such a difference is the time gap in recording the transactions of either payments or receipts.

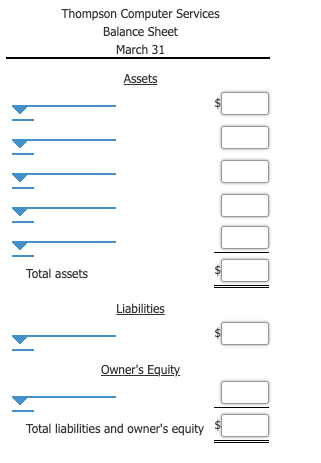

The bank reconciliation statement explains the difference between the balance in the company’s records and the balance in the bank’s records. Next, we look at how a bank uses debit and credit when referring to a company’s checking account transactions. For any reconciling items appearing in the book section, a journal entry should be recorded to adjust the cash account to the correct balance. Easily run financial statements that show exactly where your business stands. Access your cash flow statement, balance sheet, and profit and loss statement in just a few clicks.

Reconciling a bank statement is an important step to ensuring the accuracy of your financial data. To reconcile bank statements, carefully match transactions on the bank statement to the transactions https://www.kelleysbookkeeping.com/property-plant-and-equipment-pp-e-definition/ in your accounting records. With QuickBooks, you can easily reconcile bank accounts to ensure that the dollars you record are consistent with the dollars reported by the bank.

If the company properly identifies all differences and adjusts them, there should be no remaining difference between the bank book and bank statement balances. If there are still some differences, these may be due to errors in either the two balances or the bank reconciliation process. The company may need to repeat the process until the balance becomes zero, or it identifies any errors. The purpose of the bank reconciliation is to be certain that the company’s general ledger Cash account is complete and accurate. With the true cash balance reported in the Cash account, the company could prevent overdrawing its checking account or reporting the incorrect amount of cash on its balance sheet.

Got Something To Say: